sales tax permit austin texas

You do not qualify for the occasional sales. Sale Tax Permit In Texas Simple Online Application.

How To Register File Taxes Online In Texas

Also called a TXsellers permit state id wholesale resale reseller certificate.

. Complete in just 3 easy steps. Request a Duplicate Permit. Any business in Texas that plans to sell or lease tangible goods or personal property needs a Sales and Use Tax Permit.

Learn more about obtaining sales tax permits and paying your sales and use taxes for your business. Texas has 2176 special sales tax. The state of Texas requires the majority of businesses to obtain a Texas Sellers Permit also known as.

Complete in just 3 easy steps. The taxpayer number is 32077077298. Texas Comptroller of Public Accounts.

Resellers Permit Austin Texas NiRetail Trade Online Clothing Sales in Austin Hays County TX. Commercial Real Estate Residential Real Estate Multifamily Market home sales Development. The business address is 9900 Spectrum Dr Austin TX 78717.

In all likelihood the Application For Sales Tax Permit AndOr Use Tax Permit - Form AP-201 is not the only document you should review as you seek business license compliance in Austin. Sales Tax Frequently Asked Questions. Ad Get started apply for your Texas Sales Tax Permit.

Confirm Your Mailing Address. The Texas Comptroller of Public Accounts is responsible for the administration and collection of state and local sales tax for. Order FAQ.

Ad Sale Tax Permit In Texas Wholesale License Reseller Permit Businesses Registration. LLC DBA Sales Tax Permit For LLC in Austin TX 33415578701Sales Tax Permit For LLC LLC. Download Or Email Texas Sales Use Tax Forms Register and Subscribe Now.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as. You must obtain a Texas sales and use tax permit if you are an individual partnership corporation or other legal entity engaged in business in Texas and you. Who Needs a Texas Sales Use Tax Permit.

Fast easy and secure filing. Austin in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Austin totaling 2. You will need to pay an application fee when you apply for a Texas Sales Tax Permit and you will receive your permit 2-3 weeks after filing your application.

Ad Get started apply for your Texas Sales Tax Permit. Ad Fill Out Texas Sales Use Tax Forms Online Register and Subscribe Now. Select Request a Duplicate Sales Tax Permit.

In TX you may also need a sales tax ID AKA sellers permit if you sell merchandise that is taxable. Buying Selling or Discontinuing a Business. Depending on the type of business where youre doing business and other specific.

The 825 sales tax rate in Austin consists of 625 Texas state sales tax 1 Austin tax and 1 Special tax. Skip the lines apply online today. Texas Resale Certificate Texas Sellers Permit Texas Sales and Use.

Skip the lines apply online today. For additional information see our Call Tips and Peak Schedule webpage. There is no applicable county.

You must get a sales tax permit and collect tax on all later sales of taxable items beginning with the first sale after you reached the 3000 limit. Ad Sale Tax Permit In Texas Wholesale License Reseller Permit Businesses Registration. Sale Tax Permit In Texas Simple Online Application.

Austin TX 78741 United States. Learn more about registering for Texas sales taxopen_in_new and start a sales tax ID. Fast easy and secure filing.

An Austin Texas Sales Tax Permit can only be obtained through an authorized government agency. Texas Tax Appraisers Served Order in Sales Price Dispute. Austin collects the maximum legal local sales tax.

If you have specific questions regarding your business taxes owed or the application process. Tax Information from the Texas Comptrollers Office. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

You can do that by filling out and printing the application form and mail it to the Comptroller. Electronic Cigarettes and Cigarettes. Get a Texas sales and use tax ID number.

Youll need to include it on your permit application. Ad Download Or Email AP-201 More Fillable Forms Register and Subscribe Now. Get Licening for my Hays County.

:fill(white,1)/files.directliquidation.com/directliquidation/2018/01/Texas-Flag-e1517166049125.jpg)

How To Register For A Sales Tax Permit In Texas Directliquidation

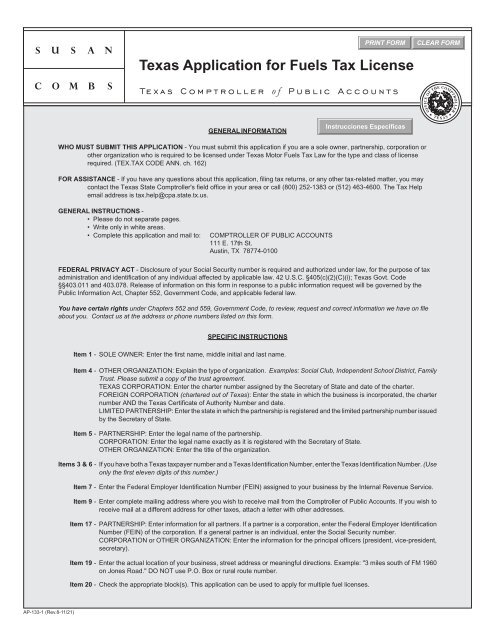

Ap 133 Texas Application For Fuels Tax License Texas Comptroller

How To Get A Texas Sales Tax Permit Texas Sales Tax Handbook

Texas Sales Tax Small Business Guide Truic

How To Register File Taxes Online In Texas

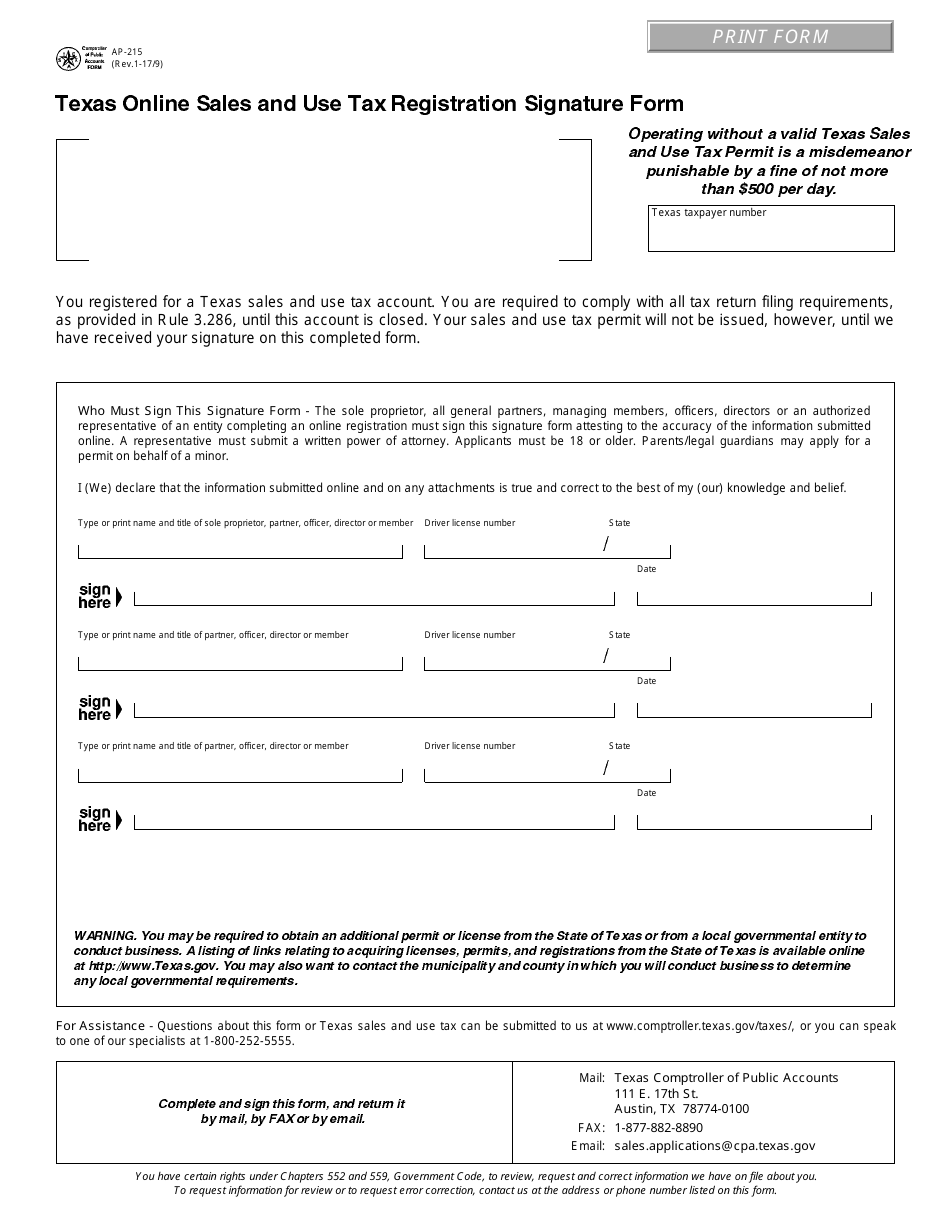

Form Ap 215 Download Fillable Pdf Or Fill Online Texas Online Sales And Use Tax Registration Signature Form Texas Templateroller

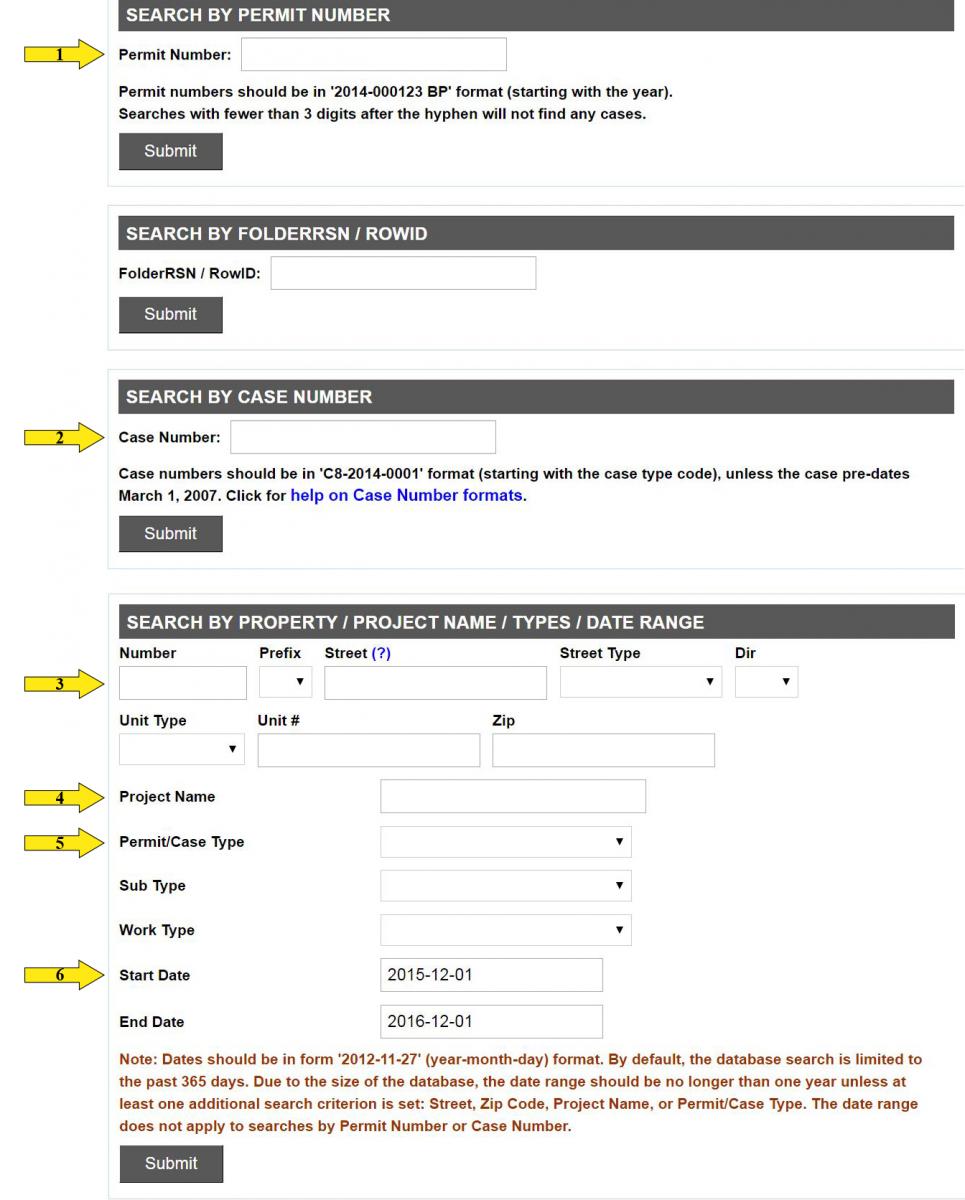

Search For Building And Development Information Austintexas Gov

Summer Dresses Under 100 Spring Fashion Casual Best Summer Dresses Summer Dresses

Do I Need A Seller S Permit For My Texas Business Legalzoom Com

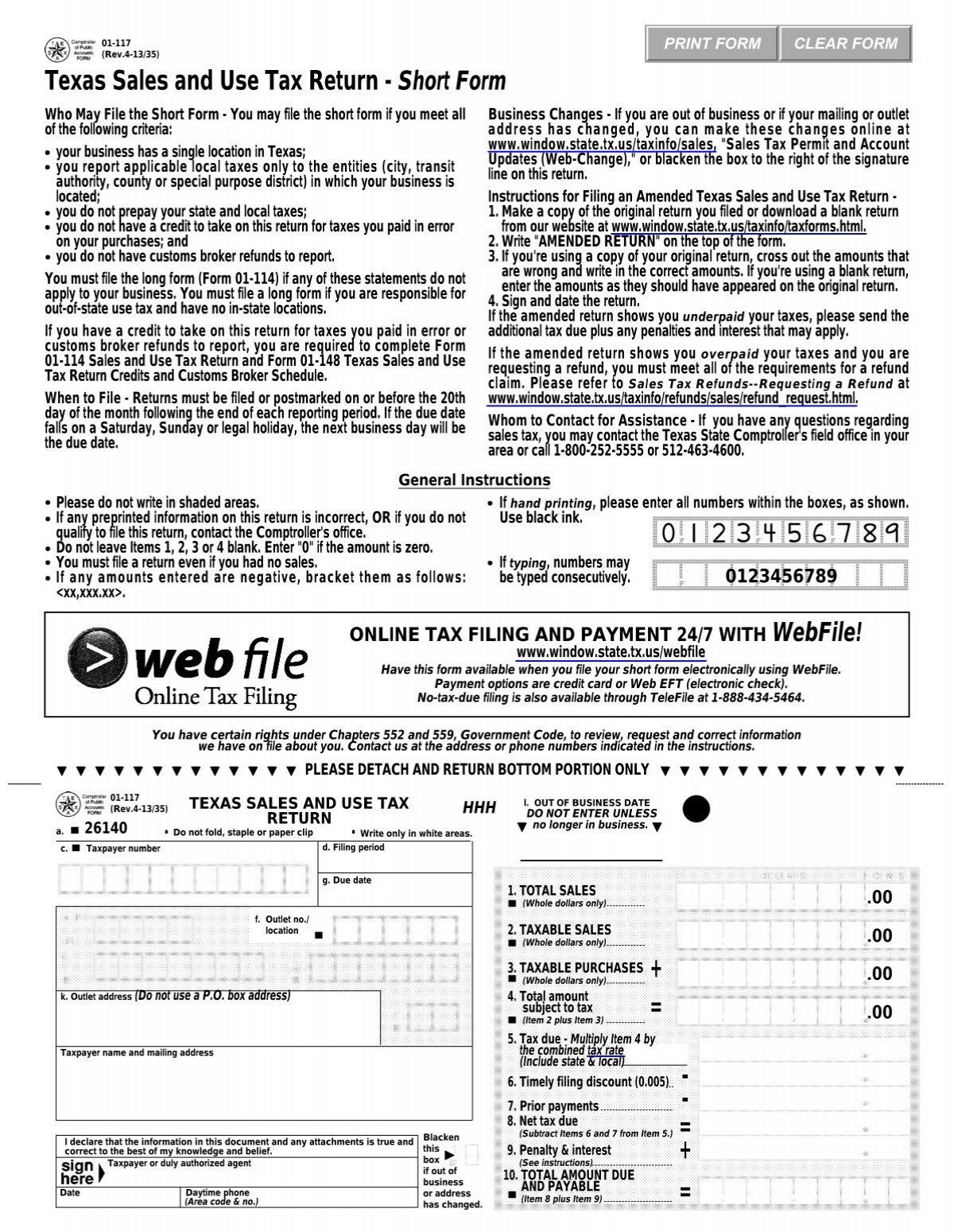

01 117 Texas Sales And Use Tax Return Short Form

How To Register File Taxes Online In Texas

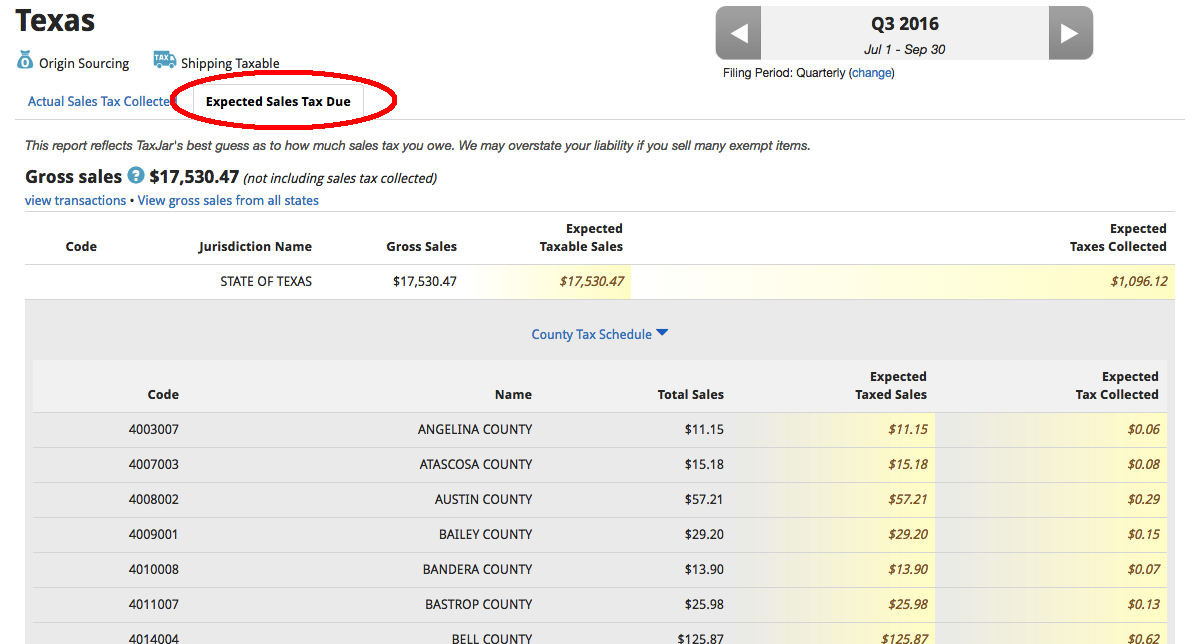

How To Register For A Sales Tax Permit In Texas Taxjar

How To Register File Taxes Online In Texas

Texas Sales Tax Guide And Calculator 2022 Taxjar

Some Texas Online Sellers Receive Alarming Sales Tax Penalty Notification Taxjar

Its Template Drivers License State Texas File Photoshop Version 2 You Can Change Name Address Bi Drivers License Id Card Template Birth Certificate Template

How To Get A Resale Certificate In Texas Startingyourbusiness Com